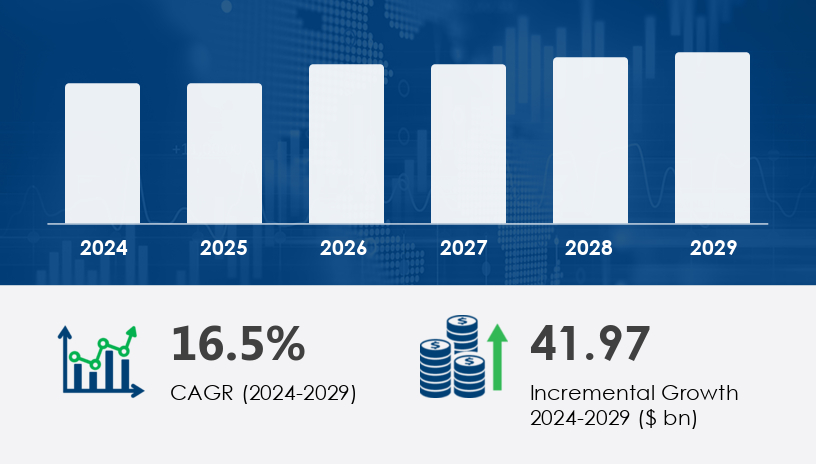

The automotive software market is on a trajectory of remarkable growth, projected to expand by USD 41.97 billion from 2024 to 2029, at a compound annual growth rate (CAGR) of 16.5%. As consumers increasingly seek differentiated in-car experiences, original equipment manufacturers (OEMs) and Tier-1 suppliers are being pushed to invest in advanced connectivity, safety, and performance-enhancing software solutions. This surge is transforming the automotive ecosystem, with Over-the-Air (OTA) updates, cybersecurity advancements, and software-defined vehicles taking center stage.For more details about the industry, get the PDF sample report for free

The rising consumer expectation for personalized and seamless in-vehicle experiences is the primary catalyst behind the market’s acceleration. Automakers are leveraging technologies such as connected car systems, vehicle performance monitoring, and real-time vehicle data management to meet evolving demands.

Additionally, easier car ownership models, the influx of tech firms into the automotive space, and improving economic conditions globally are further amplifying demand for innovative software features. High on the priority list are API integrations, OTA updates, and cloud-based platforms that allow automakers to deliver services, patches, and enhancements without physical dealership visits.

One of the most prominent trends is the adoption of OTA updates, enabling automakers to provide real-time software enhancements, improve functionality, and address bugs without requiring customers to visit service centers. The shift to advanced driver-assistance systems (ADAS) like adaptive cruise control, head-up displays, and automated valet parking is also contributing to the rapid growth of embedded and autonomous driving software.

The integration of machine learning, AI, and IoT is helping to optimize fuel efficiency, enable traffic sign recognition, and enhance remote vehicle access. This digital transformation is laying the foundation for ride-sharing models, vehicle-to-infrastructure (V2I) communication, and fleet management platforms that are redefining operational models across the industry.

Despite these advancements, the market faces notable headwinds. Chief among them is the rising complexity of automotive software architecture, which elevates both development costs and cybersecurity risks. With the increasing number of electronic control units (ECUs) and connected endpoints in vehicles, ensuring software reliability, regulatory compliance, and data security is becoming increasingly resource-intensive for OEMs and suppliers.

Additionally, validation and testing protocols for new systems such as automated emergency braking, lane departure warning, and blind spot detection require significant investment in infrastructure and expertise.

Safety System: Witnessing substantial growth, bolstered by regulations like the EU’s eCall system and NHTSA’s rear-view camera mandate. Key technologies include:

Adaptive headlights

TPMS

Emergency brake assist

Rollover prevention systems

Automated valet parking

Infotainment and Telematics

Powertrain

Chassis

Application Software

Middleware

Operating System

Passenger Vehicles

Commercial Vehicles

Electric Vehicles (EVs)

Autonomous Vehicles

Internal Combustion Engine (ICE)

Electric Vehicles (EVs)

Battery Management Systems (BMS)

Charging Management

Vehicle-to-Grid (V2G)

Autonomous Driving Software

Infotainment Software

Vehicle Management Software

Telematics Software

OEMs

Aftermarket

Tier-1 Suppliers

Get more details by ordering the complete report

APAC is anticipated to contribute 44% to the global automotive software market growth. Countries driving this surge include:

China

India

Thailand

Indonesia

These nations are witnessing increased demand for in-vehicle infotainment (IVI) and advanced driver-assistance systems (ADAS), fueled by rising disposable incomes and a shift in consumer priorities towards passenger safety. Furthermore, the region's interest in vehicle-to-vehicle (V2V) communication, connected car platforms, and software-defined vehicles is accelerating.

United States

Canada

North America remains a stronghold for technological innovation, especially in autonomous driving systems, cloud-based vehicle tracking, and ride-sharing software platforms.

Germany

France

Italy

United Kingdom

The European market is characterized by strong regulatory support, including mandates for safety features and data privacy, boosting investment in AI-driven automotive software and real-time fleet analytics.

Egypt

Oman

UAE

This region is gradually adopting connected technologies and offers growth potential in fleet management and urban mobility solutions.

Brazil

Argentina

Improvements in automotive infrastructure and digitalization are setting the stage for software innovations in these emerging markets.

The Automotive Software Market is undergoing transformative growth driven by increasing integration of technologies such as the digital cockpit, advanced infotainment systems, and ADAS systems. Key developments include the widespread use of telematics platforms, enhanced autonomous driving capabilities, and the emergence of V2X communication standards. Automakers are prioritizing seamless OTA updates and optimized ECU software to enhance functionality and maintain cybersecurity compliance. Additionally, advancements in sensor technologies like the LiDAR sensor and radar module, alongside robust vehicle OS solutions, support the evolution of the connected car ecosystem. Features such as intuitive HMI interfaces, digital twins, and scalable cloud platforms are being integrated with edge computing and dedicated cybersecurity suites to improve real-time responsiveness and data protection.

For more details about the industry, get the PDF sample report for free

The competitive landscape is marked by strategic alliances, acquisitions, and product innovation. Major players include:

Aptiv PLC – Provider of HTML5-based IVI platforms via NetFront Browser BE

Autodesk Inc.

BlackBerry QNX

Continental AG

Denso Corporation

Elektrobit Automotive GmbH

Harman International (Samsung)

Infineon Technologies AG

KPIT Technologies Ltd.

Luxoft Holding Inc.

Magneti Marelli S.p.A.

NVIDIA Corporation

NXP Semiconductors NV

Renesas Electronics Corporation

Robert Bosch GmbH

Siemens PLM Software

Texas Instruments Inc.

TomTom International BV

Wind River Systems Inc.

ZF Friedrichshafen AG

January 2024: Magna International unveiled its Magna InControl platform, focusing on advanced driver-assistance systems and enhancing software-driven mobility (Magna International Press Release).

May 2025: Intel partnered with BMW to co-develop next-gen automotive software and hardware platforms, targeting improved safety and connectivity (Intel Newsroom).

September 2024: Continental AG acquired Elektrobit, reinforcing its leadership in advanced driver assistance and autonomous driving software (Continental AG Press Release).

November 2025: The European Union launched the European Automotive Software Innovation Partnership, pledging €3 billion to fuel research and innovation in automotive software technologies (European Commission Press Release).

Get more details by ordering the complete report

In-depth analysis reveals that core automotive applications such as navigation systems, driver monitoring, lane departure warnings, and adaptive cruise control are now standard, supported by innovations in parking assist, traffic sign recognition, blind spot detection, and collision avoidance. These capabilities are reinforced by advanced vehicle diagnostics, predictive maintenance tools, and centralized fleet management platforms. Human-machine interactions are being redefined by smart dashboards, voice assistants, and gesture control, while immersive features like augmented reality and head-up displays enrich driver experience. The market is further supported by a layered software stack, robust middleware layers, and seamless API integration. Enhanced data analytics, machine learning, and neural networks enable precise sensor fusion, updated map databases, and refined path planning. Integrated control units, efficient powertrain software, and reliable battery management systems are also critical to supporting electric and autonomous vehicle operations.

Safe and Secure SSL Encrypted