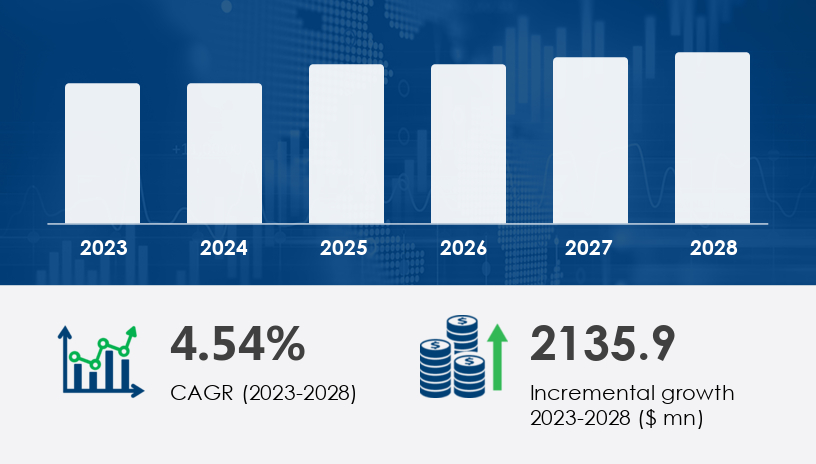

The automotive LED lighting market is set for remarkable growth in the coming years, with projections indicating an increase of USD 2.14 billion, representing a compound annual growth rate (CAGR) of 4.54% from 2023 to 2028. This upward trajectory reflects the rapid adoption of LED technology in automotive lighting, driven by factors like energy efficiency, safety concerns, and technological advancements. The 2025 outlook suggests that both passenger cars and commercial vehicles will increasingly rely on LED lights to enhance safety, reduce costs, and comply with ever-stricter regulatory standards. This article serves as a comprehensive guide to understanding the automotive LED lighting market, its growth drivers, challenges, and the innovations set to reshape the industry.

For more details about the industry, get the PDF sample report for free

The Automotive LED Lighting Market is witnessing significant advancements due to the increasing adoption of energy-efficient solutions, with LED technology leading the way. Adaptive headlights, matrix LED systems, and OLED lighting are gaining popularity for their ability to enhance vehicle aesthetics and improve safety features. As vehicles become more sophisticated, dynamic sequencing and glare-free beams are integrated to provide better road visibility and reduce traffic collisions. The development of smart lighting systems, including LED headlamps and ambient interior lighting, is also shaping the market. Moreover, advancements in battery technology and thermal management systems are helping to optimize the performance and longevity of lighting systems in vehicles, with features like high-beam assist and customizable lighting further improving driving experiences. The incorporation of lighting design elements such as projector and reflector headlights, as well as the inclusion of rear fog and turn signals, is contributing to the growing demand for innovative lighting solutions in the automotive industry.

The automotive LED lighting market is no longer a niche segment within the larger automotive industry — it is a critical component of vehicle design and performance. The move towards LED lights in vehicles is driven primarily by two key factors: energy efficiency and enhanced safety.

LED lights offer superior brightness, a longer lifespan, and lower power consumption compared to traditional halogen and xenon lighting systems. According to recent data, the automotive LED lighting market is poised for rapid expansion, with Asia-Pacific (APAC) leading the charge in both production and demand. This shift is not just about aesthetics or innovation; it's about addressing the industry's growing focus on sustainability and driver safety.

Experts predict that the exterior lighting segment will experience the most substantial growth, fueled by the rise of hybrid LED headlights, which combine projector and reflector technologies with lasers. These hybrid headlights not only improve the aesthetic appeal of vehicles but also offer glare-free lighting, a feature that is increasingly in demand by consumers and regulatory bodies.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report.

Several interrelated factors are propelling the growth of the automotive LED lighting market. Below are the primary drivers of this expansion:

The adoption of LED technology is largely driven by the desire for more energy-efficient lighting systems. Traditional lighting solutions, such as halogen bulbs, are much less efficient, consuming more energy and generating more heat. In contrast, LED lights use far less energy, resulting in significant cost savings for consumers over time. In addition to their energy efficiency, LEDs have a much longer lifespan than their halogen counterparts. This not only reduces maintenance costs but also supports sustainability by reducing waste.

Governments and regulatory agencies around the world are tightening standards for automotive lighting systems. For example, in the United States, there are specific regulations surrounding beam patterns and intensity for headlights. As a result, automakers are increasingly adopting LED solutions, which can easily meet these regulatory requirements while offering better lighting performance. Regulations mandating glare-free lighting in vehicles, especially for commercial vehicles, further emphasize the importance of advanced LED systems.

The automotive industry is witnessing rapid technological innovation, particularly in adaptive lighting systems. These intelligent lighting systems can adjust their brightness and direction based on driving conditions and weather, improving visibility and enhancing road safety. Matrix LEDs, OLEDs, and laser lighting are some of the emerging technologies making waves in the industry. These advancements are not only improving the functionality of automotive lighting systems but are also providing a more aesthetically pleasing driving experience.

As consumer preferences shift toward luxury vehicles, there is an increasing demand for high-performance lighting systems. Matrix LEDs and projector headlights are becoming standard features in luxury cars, providing superior visibility and an upscale driving experience. While these lighting systems come with higher upfront costs, they offer significant long-term benefits, including greater safety, reduced glare, and better energy efficiency.

The adoption of Advanced Driver-Assistance Systems (ADAS), including automatic high beams and lane-keeping assist, is pushing demand for glare-free, adaptive lighting systems. With traffic accidents and collisions still a significant concern globally, automakers are prioritizing safety features in their vehicles. LED lighting plays a vital role in improving visibility, helping drivers navigate at night or in poor weather conditions.

The automotive LED lighting market is undergoing several key trends, each driven by technological advancements and evolving consumer expectations. Here are the top trends to watch:

Hybrid LED headlights are poised to revolutionize the lighting systems of both passenger and commercial vehicles. These systems combine the best features of projector headlights, reflector headlights, and laser lighting, offering enhanced brightness and reduced glare. Companies like OSRAM are already leading the charge in developing hybrid LED systems that offer a better driving experience by adapting to road conditions and weather.

As ADAS features continue to integrate into vehicles, adaptive lighting systems are becoming essential. These lighting systems adjust the brightness and direction of the lights in real time, improving visibility and reducing glare. The growing popularity of ADAS technologies is expected to further drive the demand for high-performance automotive lighting systems.

The development of intelligent lighting systems that can adjust based on environmental conditions is another trend shaping the future of automotive LED lighting. Such systems improve safety by ensuring optimal lighting during driving. This trend aligns with the shift toward smart cars and greater integration of IoT (Internet of Things) technologies in vehicles.

The Asia-Pacific (APAC) region is anticipated to be the dominant force in the automotive LED lighting market, contributing 61% of the market share by the end of the forecast period in 2028. This growth is attributed to the large number of automotive manufacturers in countries like China, Japan, India, and South Korea, as well as the increasing demand for energy-efficient lighting systems in emerging markets like Thailand and Indonesia.

In addition, the passenger car segment in APAC is expected to grow at a faster pace than in developed regions such as North America and Europe. As the automotive industry continues to expand in this region, LED lighting is becoming a standard feature in both luxury and economy cars.

While the growth of the automotive LED lighting market is promising, there are several challenges that companies must navigate:

The production of LED lighting systems is heavily reliant on materials like aluminum, copper, and PVC. The rising cost of these raw materials, exacerbated by fluctuations in the global market, is a significant challenge for manufacturers. For example, the price of crude oil impacts the cost of PVC, while the depreciation of the Chinese yuan can affect the cost of components produced in China.

Despite the numerous benefits of LED lighting, the high initial costs associated with advanced lighting technologies like OLEDs and laser headlights can be prohibitive. As a result, mass-market vehicles may not immediately adopt these technologies, potentially slowing down the overall market growth.

Supply chain disruptions, especially in the wake of the global pandemic, continue to challenge manufacturers. The shortage of key components, such as semiconductors, has led to delays in the production of automotive lighting systems, affecting overall market growth.

Get more details by ordering the complete report

Looking ahead, the automotive LED lighting market will continue to grow, driven by technological advancements, increased consumer demand for energy-efficient solutions, and regulatory pressures. The emergence of hybrid LED headlights and intelligent lighting systems is set to redefine the lighting experience for drivers. By 2028, we can expect further innovations, lower production costs, and more widespread adoption of LED lighting across various vehicle types, from passenger cars to commercial vehicles.

Invest in R&D: Companies should continue to invest in research and development to stay ahead of the curve with cutting-edge lighting technologies like laser lighting and adaptive LED systems.

Optimize Supply Chains: Manufacturers should work towards optimizing their supply chains to reduce the impact of raw material cost fluctuations.

Embrace Sustainability: With rising consumer awareness about sustainability, automakers should emphasize the environmental benefits of LED lighting systems in their marketing strategies.

The automotive LED lighting market is seeing a rise in applications across both passenger vehicles and two-wheelers, driven by the increasing demand for energy-efficient, eco-friendly solutions. The rise of autonomous driving is prompting a need for more advanced lighting technologies, such as laser lighting and LED controllers, which support road safety and enhance vehicle aesthetics. The integration of indium gallium and aluminum gallium materials is driving improvements in light intensity and beam pattern precision. The focus on vehicle safety is leading to the expansion of glare-free beams, high-beam assist, and fog lights for enhanced road safety. Additionally, with the shift towards energy-efficient and sustainable solutions, the market is experiencing a surge in eco-friendly products and innovations in charging infrastructure. The market is also benefiting from the growing popularity of features such as interior lighting and brake lights that offer both functional and aesthetic enhancements for modern vehicles.

Safe and Secure SSL Encrypted