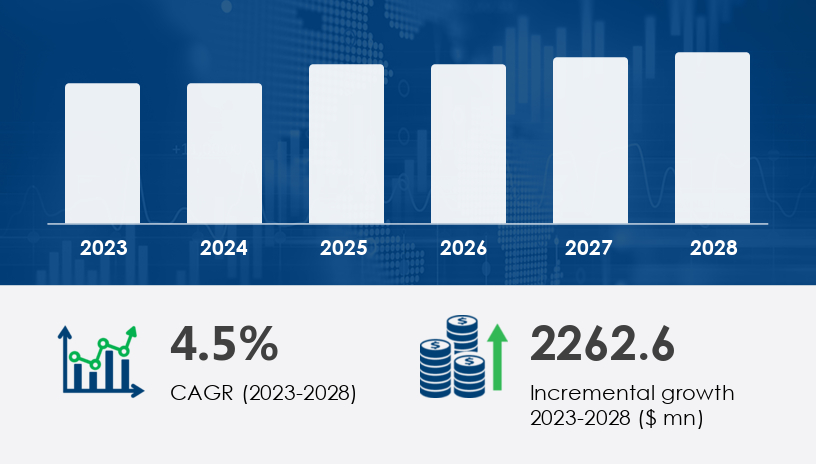

The global automotive headliner market size is projected to grow by USD 2.26 billion between 2023 and 2028, accelerating at a CAGR of 4.5%. This surge reflects not only an uptrend in passenger vehicle adoption—particularly SUVs—but also the mounting importance of smart interiors and safety-integrated components in automotive design. In this 2025 Outlook and Strategic Guide, we explore why this dynamic market is drawing attention from OEMs, material innovators, and interior system suppliers alike.For more details about the industry, get the PDF sample report for free

At its core, the automotive headliner market centers around an essential, yet often underappreciated, element of vehicle interiors—the ceiling covering. More than just an aesthetic layer, headliners now incorporate advanced materials for shock absorption, insulation, UV protection, and even integration with smart systems like ambient lighting and air circulation.

“The headliner is evolving from a passive liner to an active interface in the smart cabin revolution,” says Senior Analyst at Technavio

The passenger car segment—valued at USD 6.56 billion in 2018—remains the most dominant and fastest-growing. SUVs, in particular, are the growth engine. Nearly 74% of SUV models now include sunroofs, integrated AC ducts, and complex wiring, necessitating more sophisticated headliner designs.

“Passenger cars today are mini command centers,” explains Senior Analyst at Technavio. “They need adaptable, lightweight, and feature-rich headliners to keep up with evolving consumer expectations.”

While not growing as quickly as the passenger segment, commercial vehicles demand durable, cost-efficient headliner solutions capable of withstanding high usage and variable conditions—important for fleets and logistics providers aiming to lower total cost of ownership.

Driven by rapid urbanization, rising vehicle ownership rates, and a growing preference for SUVs and luxury vehicles, Asia Pacific dominates the automotive headliner market. China, in particular, has become a hotspot for OEM innovation and scale efficiencies, giving manufacturers the leverage to offer more advanced headliner systems.

“Economies of scale in Asia Pacific are unmatched,” notes Senior Analyst at Technavio “This allows suppliers to develop and roll out premium features like solar glass and insulation at more competitive pricing.”

North America & Europe: Focused on sustainability and lightweighting, responding to stringent emissions regulations.

South America & Middle East/Africa: Emerging interest driven by growing urban class and OEM expansion into untapped territories.

Get more details by ordering the complete report

OEMs are increasingly adopting standardized interior platforms across vehicle types to reduce costs and streamline production. This allows for shared headliner architectures across sedans, SUVs, and even commercial vehicles.

The rise of autonomous vehicles and connected interiors has propelled demand for multi-functional headliners. Features now include:

3D laminated glass integration

Acoustic insulation foams

Advanced wiring enclosures for sensors and AR HUDs

With increased focus on fuel efficiency and emission reduction, manufacturers are turning to lightweight fabrics and foams. These not only cut weight but also enhance thermal and sound insulation.

A leading Japanese OEM revamped its SUV lineup in 2024 with a new headliner system featuring:

Integrated solar glass for panoramic roofs

Noise-dampening foam for highway comfort

Hidden channels for smart lighting and cabin sensors

Result: Customer satisfaction scores rose by 28%, and production costs fell by 12% due to standardized components across five models.

For more details about the industry, get the PDF sample report for free

The Automotive Headliner Market is witnessing significant growth driven by innovations in materials and consumer demand for comfort and aesthetics. Manufacturers are incorporating a variety of materials such as polyurethane headliner, non-woven headliner, fiberglass headliner, and 3D-laminated headliner to improve durability and design flexibility. Demand is rising for lightweight headliners, insulated headliners, and shock absorption headliners that enhance vehicle efficiency and occupant safety. The rise of the smart cabin headliner has introduced advanced features like haptic sensor headliners and augmented reality headliners, offering interactive in-vehicle experiences. Additionally, aesthetic preferences are influencing the popularity of fabric headliners, foam headliners, composite headliners, and luxury options like Alcantara, suede, and vinyl headliners. These developments align with the increasing adoption of energy-efficient headliners, acoustic headliners, and solar glass headliners, reinforcing trends toward quieter, more sustainable vehicle interiors.

Prices of polyester, injection-molded plastic, and metal substrates are susceptible to global economic shifts and oil market fluctuations. This affects Average Selling Prices (ASP) and squeezes margins, particularly for Tier-1 suppliers.

Stringent mandates on vehicle weight and CO₂ emissions are pressuring suppliers to rethink material mixes. However, innovation in bio-composites and recycled polymers is offering a promising path forward.

Get more details by ordering the complete report

Invest in R&D for multi-functional headliners—especially for SUVs and electric vehicles, where interior experience is a major brand differentiator.

Build flexible supply chains to mitigate risks related to raw material pricing.

Expand footprint in APAC, where scale and demand are poised to drive profitability.

Collaborate with tech startups working on smart fabrics, AR displays, or modular wiring systems.

By 2028, the automotive headliner will no longer be just a static element. It will be an active, multi-sensor component of smart cabins—potentially embedded with haptics, sensors, and ambient tech to transform how users interact with vehicles.

Research analysis indicates a strong shift toward multifunctional and customizable solutions in the Automotive Headliner Market, with emphasis on both performance and design. Trends such as noise-reducing headliners, thermal headliners, and recyclable headliners are shaping eco-conscious production strategies. Technologies like LED headliners, headliner lighting, and headliner displays are becoming standard in modern vehicles, offering ambient illumination and infotainment integration. The emergence of modular headliners, integrated headliners, and flexible headliners provides OEMs with scalable options for various vehicle segments. Material innovations also include soft-touch headliners, molded headliners, and rigid headliners, each catering to different tactile and structural preferences. Key components such as headliner substrates, headliner adhesives, headliner foams, and headliner fabrics play critical roles in ensuring product performance and longevity. Further, with rising interest in sunroof-integrated designs, headliner sunroof systems are gaining popularity, while headliner acoustics, headliner sensors, and eco-friendly headliners continue to enhance overall driving experience and sustainability.

OEMs should standardize platforms to enable headliner customization at scale.

Material suppliers need to diversify sourcing strategies and explore recyclable options to meet sustainability goals.

Market entrants must focus on value-added design, targeting niche segments like EVs and luxury cars.

For more details about the industry, get the PDF sample report for free

Safe and Secure SSL Encrypted