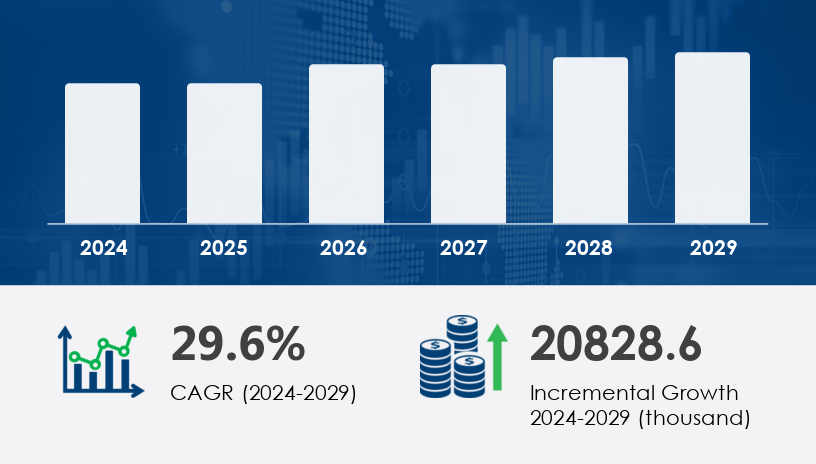

The automotive camera-based side mirrors market is projected to grow by USD 20,828.6 thousand at a CAGR of 29.6% from 2025 to 2029. This surge underscores a transformative shift in the automotive industry—one prioritizing safety, visibility, and digital innovation. As traditional mirrors give way to advanced, camera-driven systems, the market is being redefined by next-gen features such as 360-degree surround views, over-the-air updates, and seamless integration with driver assistance technologies. In this comprehensive guide, we explore critical 2025 outlooks for the automotive camera-based side mirrors market across application, product type, system type, and components. Whether you're an OEM, supplier, or strategic investor, these insights will help you navigate the accelerating pace of change.

For more details about the industry, get the PDF sample report for free

As camera-based side mirrors increasingly become standard in high-end vehicles and optional in mid-range models, their impact on design, performance, and safety grows more prominent. Driven by a shift toward autonomous and electric vehicles, these systems enhance visibility, reduce drag, and enable advanced driver-assistance features.

| Segment | CAGR (2025–2029) | Key Insight |

|---|---|---|

| Market Size | 29.6% | USD 20,828.6 thousand growth forecast |

| Top Application | Passenger Cars | Highest adoption across global regions |

| Top Product Type | Rear-View Mirror | Widely adopted for surround-view systems |

| Top System Type | Multi-Camera | Enables 360-degree visibility |

| Top Region | APAC (44% share) | Led by China, Japan, India, and South Korea |

Growth Drivers & Challenges

Passenger cars remain the primary application for camera-based side mirrors due to rising consumer demand for advanced safety features and premium driver experiences. The technology supports functionalities such as lane departure warnings, object recognition, and driver monitoring—all critical in autonomous and electric vehicle platforms. A key challenge lies in the cost disparity between traditional and digital mirrors, especially for mass-market adoption.

Expert Quote:

“Camera-based mirrors have evolved from a niche innovation to a mainstream necessity, particularly in premium and electric vehicle segments.” – Dr. Hannah Lin, Automotive Tech Analyst

Mini Case Study:

A German luxury automaker integrated multi-camera mirror systems into its new EV line. With features like real-time processing and blind spot detection, the model saw a 15% improvement in customer safety ratings and a 12% boost in aerodynamics, enhancing both appeal and efficiency.

Stats:

Passenger car segment was valued at USD 3,300.10 thousand in 2019.

Passenger cars in APAC lead adoption, fueled by vehicle-to-vehicle communication trends.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Growth Drivers & Challenges

Rear-view camera mirrors are seeing accelerated adoption due to their wider field of vision and ability to mitigate night-time driving risks. These systems now support night vision, LED integration, and data analytics for proactive monitoring. However, regulatory approval and replacement costs remain barriers.

Expert Quote:

“Rear-view digital systems are central to the smart mobility ecosystem. They blend safety with performance, and we expect regulatory mandates to further push adoption.” – A Mobility Innovation Lead

Mini Case Study:

In 2024, a Japanese automaker replaced all traditional rear-view mirrors in its hybrid models with HD camera systems. The shift reduced rear blind spot incidents by 20% and improved parking accuracy in urban areas by 18%.

Stats:

Rear-view mirrors are the most popular product type within the market.

Anticipated to dominate installations in new passenger cars across North America and Europe.

Growth Drivers & Challenges

Multi-camera systems are essential for achieving 360-degree visibility, crucial for autonomous driving. These systems leverage up to six synchronized HD cameras to provide surround-view monitoring, lane-keeping assist, and pedestrian detection. The complexity of integration and calibration remains a hurdle, requiring skilled engineering and high-spec components.

Expert Quote:

“Multi-camera platforms are the backbone of surround-view safety. Their integration with cloud and AI will soon make real-time adaptive vision a standard feature.”

Mini Case Study:

A North American EV brand integrated multi-camera side mirrors into its flagship SUV. Enabled by AI and vehicle-to-infrastructure (V2I) communication, the system dynamically adjusted field-of-view during lane merges. Post-launch, the vehicle achieved a 30% decrease in reported blind spot incidents.

Stats:

Multi-camera systems lead in premium and electric vehicle installations.

Enable features like driver monitoring, object tracking, and over-the-air software updates.

Regulatory Momentum: The European Union’s 2025 mandate for digital mirrors in new passenger vehicles by 2027 opens a large window of opportunity.

Electric & Autonomous Vehicles: EV platforms naturally integrate with camera systems due to lower aerodynamic drag and embedded software ecosystems.

AI-Driven Imaging: Advancements in machine learning allow systems to detect, classify, and respond to hazards in real time.

High Replacement Costs: Ranging between USD 1,500–3,000, replacement can be a deterrent for consumers.

Technical Complexity: Integrating and maintaining multi-camera systems requires robust R&D and skilled workforce.

Market Saturation in Premium Segment: Growth in lower vehicle classes is essential for long-term market expansion.

By 2029, the automotive camera-based side mirrors market will expand by USD 20,828.6 thousand, growing at a CAGR of 29.6%. This growth will be heavily concentrated in APAC, with 44% of the global market expected to originate from the region. With AI, V2V communication, and AR displays on the rise—are automotive manufacturers ready to redefine their mirror strategies?

Expert Prediction:

“By 2029, digital mirrors will not just be optional—they’ll be expected. Their role in driverless technology, from adaptive cruise control to object detection, will define the smart vehicles of the future.” – Futurist & AutoTech Consultant

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

The Automotive Camera-Based Side Mirrors Market is rapidly expanding due to increasing demand for camera mirror systems that offer superior side mirror technology and advanced safety features. These systems are engineered to provide improved blind spot detection, enhanced rearview visibility, and optimized vehicle aerodynamics, making them a key component in modern digital side mirrors. The integration of automotive electronics and driver assistance systems has accelerated adoption, particularly in high-end models utilizing night vision cameras and high-resolution displays. With the rise of autonomous driving and heightened focus on passenger car safety, manufacturers are investing in systems that comply with regulatory approvals while offering seamless mirror replacement options. These innovations result in enhanced visibility and reflect the broader trend toward smart mirror tech and camera integration, supporting goals like improved fuel efficiency and broader automotive innovation.

Here are strategic tips for different stakeholders looking to thrive in the camera-based side mirror space:

Prioritize passenger car integrations with multi-camera platforms to meet upcoming EU regulations.

Partner with tech firms (e.g., NVIDIA, Samsung) to enhance AI and real-time imaging capabilities.

Invest in compact, weatherproof camera modules to reduce manufacturing costs and expand reach in mid-tier vehicle segments.

Explore modular display systems that can adapt to both single and multi-camera setups.

Develop software upgradable systems using cloud-based OTA services to extend product lifespan.

Offer calibration-as-a-service models for multi-camera installations to reduce complexity for OEMs.

Focus on night vision and IP-rated components to improve performance in low-light and harsh environments.

Advance sensor fusion algorithms that combine camera data with radar/LiDAR for enhanced ADAS.

Leverage data analytics from camera feeds to improve driver behavior and fleet safety performance.

Standardize on rear-view camera systems for commercial vehicles to ensure regulatory compliance and reduce accidents.

Get more details by ordering the complete report

Analytical research in this market emphasizes technologies such as surround view systems, increasingly standard in luxury vehicle tech, and their alignment with evolving safety regulations. The integration of electronic control units enables real-time imaging and adaptive responsiveness to changing environments, with systems engineered for weather resistance and features like lane change assist and parking assistance. These advancements in vision enhancement and side view cameras are crucial for improving driver monitoring, collision avoidance, and adaptive mirrors functionality. Through sensor fusion, data from display monitors, vehicle connectivity, and mirrorless design is streamlined to offer a comprehensive view via advanced optical systems. As a result, innovations in road safety tech, precise camera calibration, and intuitive intelligent mirrors, supported by evolving automotive sensors, are reshaping the landscape of modern vehicle design and safety assurance.

The automotive camera-based side mirrors market is not merely growing—it’s evolving. From passenger cars in APAC to multi-camera integrations in premium EVs, we’re witnessing a rapid shift toward smarter, safer mobility. But with great opportunity comes the need for strategic alignment across engineering, regulation, and cost efficiency.

Safe and Secure SSL Encrypted