"We’re not just reducing emissions—we're reengineering the powertrain ecosystem," said a senior executive at a recent automotive tech conference in Frankfurt. This perspective marks a significant pivot in how the automotive industry views the automotive active purge pump market—no longer a support component, but a core enabler of global decarbonization and energy transition goals.

From regulatory mandates to electric vehicle (EV) expansion, the active purge pump, once an invisible cog in the emissions control system, is emerging as a critical differentiator in vehicle performance, compliance, and sustainability. As we step into the 2024–2028 era, we’re witnessing a Next-Gen Outlook where purge pumps become smarter, lighter, and more integrated with hybrid and electric architectures.

For more details about the industry, get the PDF sample report for free

In 2019, the automotive sector manufactured over 67 million passenger vehicles globally, with emission control largely reliant on passive systems. As regulations tightened, particularly in Europe and North America, the automotive active purge pump gained prominence by actively removing hydrocarbon vapors from fuel tanks.

By 2023, the market had gained traction thanks to:

Growing EV adoption

Stringent hydrocarbon evaporation standards

Fuel system innovation from OEMs like Bosch and Continental

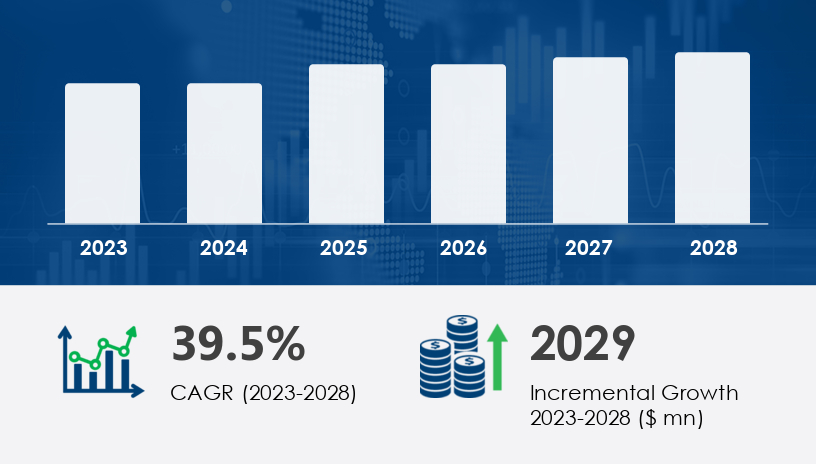

Looking ahead, from 2024 to 2028, the market is forecast to grow by USD 2.03 billion, achieving a staggering CAGR of 39.5%. This exponential growth is driven by the dual forces of electrification and emissions policy.

Legacy Disruption: Passive evaporative systems failed to meet next-gen emission norms.

New Strategy Emerging: Integration of on-board diagnostics (OBD) and brushless DC motors for optimized control.

Analyst Insight: “Passenger vehicles dominate market share due to rising consumer awareness and disposable income, especially in Europe.”

Business Case: Audi’s 2024 hybrid fleet update includes ultra-light purge pumps integrated with fuel vapor management systems.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

Legacy Disruption: Gasoline evaporation once treated as a secondary issue in emission design.

New Strategy Emerging: Active systems now mitigate VOCs during engine off-cycles and EV refueling.

Analyst Insight: “Active purge systems are now essential in plug-in hybrids and modern gasoline platforms, especially in emission-heavy urban regions.”

Business Case: Toyota’s mid-cycle hybrid refresh features purge systems co-developed with DENSO using vacuum forming to reduce weight.

Legacy Disruption: Fuel vapor recovery was inconsistent across global models.

New Strategy Emerging: OEMs use non-metal components and injection molding to meet global compliance.

Analyst Insight: “The shift to consistent, real-time emission control across vehicle types is redefining performance metrics.”

Business Case: Bosch’s new EPA-approved system reduces emissions in gasoline engines while boosting fuel efficiency.

Stricter carbon and VOC standards are not hurdles—they're catalysts. Europe remains the crucible, where brands like BMW and Mercedes embed advanced systems to stay ahead of EU norms.

Strategic alliances are turbocharging innovation. In July 2024, Magna and Honeywell joined forces to develop next-gen electrically driven purge systems—an early sign of consolidation around performance and efficiency.

Companies investing in vacuum forming, injection molding, and non-metallics are setting cost and weight benchmarks. Denso's October 2025 investment in European capacity reflects this strategy.

The Automotive Active Purge Pump Market is witnessing steady growth due to the increasing demand for advanced active purge solutions that help manage evaporative emissions in modern vehicles. These systems play a vital role in controlling fuel vapor release through integrated purge pump and canister purge functionalities, aligning with strict emission standards. The heart of the system is the charcoal canister, which captures vapors from the fuel tank and releases them in a controlled manner via the purge valve. Supporting components such as the vacuum pump, pump actuator, and valve timing technologies are critical for maintaining proper fuel system performance and improving engine efficiency. The market includes a wide range of automotive pump solutions designed for vapor recovery and pollution control, ensuring compliance with emission control regulations. Other integrated features include exhaust gas monitoring and air intake optimization, both of which contribute to the reduction of carbon emissions.

AI-Integrated Smart Pumps

Expect AI-driven feedback loops that adjust purge activity based on driving patterns and climate conditions.

Battery-Linked Vapor Systems

In battery-powered vehicles, integrated purge systems could double as energy transfer moderators during regenerative braking cycles.

Modular Component Architectures

OEMs may shift toward plug-and-play emission modules, streamlining design and production.

Innovation in Action: Continental’s February 2024 Active Pure Air Technology has redefined air filtration by combining cabin and fuel vapor management in one system.

Are traditional fuel systems ready to coexist with adaptive, smart vapor recovery modules by 2028?

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

Embrace lightweight component design

Prioritize non-metallic purge pump materials using injection molding and vacuum forming to meet weight targets.

Integrate OBD and sensor ecosystems

Ensure compatibility with on-board diagnostics and smart sensors for real-time hydrocarbon management.

Plan for hybrid-centric engineering

Design purge systems that operate seamlessly across both gasoline and electric fuel systems.

Invest in brushless DC motor platforms

These ensure longevity, reduced noise, and better energy efficiency for purge systems in EVs.

Leverage strategic alliances for tech advantage

Follow models like Magna–Honeywell to accelerate market entry with electrically driven purge pumps.

Target cost-performance equilibrium

Balancing cost-effective active purge pump production with emissions compliance is key to market viability.

Detailed analysis of the Automotive Active Purge Pump Market reveals technological advancements focused on enhancing vapor management and meeting emission compliance requirements. Components like the pump controller, purge solenoid, and canister system are optimized to regulate vapor purge efficiently and ensure effective vapor control. The system architecture includes precise pump mechanism designs and high-performance pump modules that connect to vapor lines, maintaining appropriate fuel pressure throughout the process. Devices such as emission sensors and canister vent systems aid in real-time monitoring of purge flow and fuel evaporation, ensuring reliable feedback and system calibration. Additionally, enhanced air filtration methods support improved air quality, while fuel recovery processes reduce overall fuel emissions. The complete pump assembly, driven by engine vacuum, reflects the industry's move toward more sustainable and efficient vehicle systems.

The automotive active purge pump market has evolved from a background component to a strategic pillar of the global clean mobility mission. What was once a regulatory checkbox is now a battlefield for innovation, compliance, and brand differentiation.

By 2028, the defining brands won't just meet standards—they’ll set them. They’ll do it through smart, lightweight, and AI-enabled purge systems embedded within the very DNA of hybrid and electric platforms.

Are we thinking big enough about the role of active components in vehicle transformation?

Access our Full 2024–2028 Playbook to lead your market transformation.

Safe and Secure SSL Encrypted