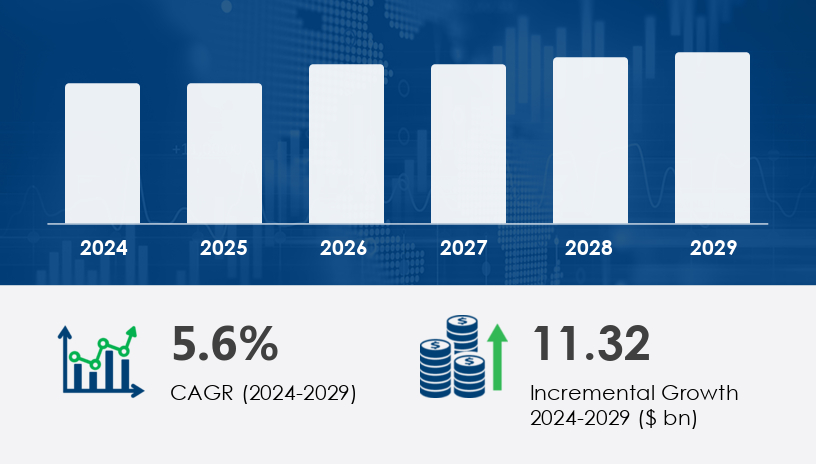

The Aircraft Engine MRO Market is poised for robust expansion as the aviation industry rebounds and evolves with advanced technologies. In 2024, the market size stood at a substantial level and is projected to grow by USD 11.32 billion from 2025 to 2029, advancing at a CAGR of 5.6%. This growth is propelled by rising air traffic, an expanding global aircraft fleet, and increasing investments in maintenance infrastructure and capabilities. Both commercial and military aviation segments are heavily reliant on effective MRO (Maintenance, Repair, and Overhaul) services to ensure operational readiness and safety.

For more details about the industry, get the PDF sample report for free

A critical factor driving the Aircraft Engine MRO Market is the escalating investments in MRO facilities worldwide, especially in emerging aviation hubs. As air traffic increases and airlines expand their fleets, the need for reliable, cost-efficient engine maintenance solutions has surged. For instance, Airbus Helicopters opened a new MRO facility in Singapore, strengthening maintenance support in the Asia-Pacific region. Similarly, Lockheed Martin Corporation launched a facility in Japan dedicated to advanced fighter jets, emphasizing the global demand for specialized MRO capabilities. These developments underline how strategic infrastructure investments are enabling MRO service providers to meet growing needs and reduce turnaround time while enhancing safety and efficiency. According to analysts, such expansion is vital for meeting the complex maintenance requirements of next-generation aircraft engines.

An emerging trend shaping the market is the adoption of 3D printing technology for component manufacturing and repair. This innovation significantly improves turnaround time by enabling the rapid creation of complex parts on demand. Digitization and automation in engine maintenance processes are also becoming more prevalent, particularly with next-generation engines like the LEAP-1B, which require expensive materials and precision maintenance techniques. Airlines and military forces are forming long-term joint ventures with MRO providers to incorporate these technologies into their operations, aiming to reduce maintenance costs and ensure regulatory compliance. Analysts note that these advanced technologies are becoming standard practice across MRO centers worldwide.

The Aircraft Engine MRO (Maintenance, Repair, and Overhaul) Market plays a critical role in ensuring the safety, performance, and lifecycle optimization of aircraft propulsion systems. This sector encompasses services for various engine types, including turbofan engines, turboprop engines, and gas turbines, each requiring specialized attention during engine overhaul and scheduled maintenance. Core tasks such as blade repair, compressor maintenance, and combustor repair are vital for maintaining engine integrity, especially in high-stress components like turbine blades and fan blades. Additional services include APU maintenance, fuel nozzle inspection, bearing replacement, and thrust reverser servicing, ensuring optimal performance under diverse flight conditions. As engine technologies advance, engine upgrade and engine retrofit programs are being implemented to improve efficiency and regulatory compliance.

The Aircraft Engine MRO Market is segmented as follows:

By Application

Commercial Aviation

Military Aviation

General Aviation

By Type

Turbofan and Turbojet

Turboprop

The commercial aviation segment leads the Aircraft Engine MRO Market in terms of market share and anticipated growth. Valued at USD 24.51 billion in 2019, it continues to grow steadily due to the increasing number of aircraft and high utilization rates. Airlines conduct routine inspections, lubrication, and component replacements to ensure safety and comply with regulations such as those from the FAA and EASA. Overhauls—driven by flight hours or mandates—are essential for maintaining airworthiness. As newer engine models with more complex components enter the market, the demand for digitized, automated maintenance systems has grown, enhancing turnaround time and efficiency. According to Technavio analysts, this segment's growth is further bolstered by the aviation industry's strict safety requirements and a rising number of long-haul and regional flights.

Covered regions:

North America

Europe

APAC

South America

Middle East and Africa

North America is forecast to account for 37% of the global Aircraft Engine MRO Market growth during the forecast period, making it the top contributor. The region’s mature aviation ecosystem, comprising established airlines and a high density of aircraft, drives consistent demand for engine maintenance services. The U.S. and Canada host several prominent MRO centers and OEMs, offering specialized services for commercial and military fleets. Furthermore, the APAC region is experiencing rapid growth, driven by low-cost carriers, rising tourism, and a growing middle class. Fleet expansion and the increasing adoption of energy-efficient aircraft also contribute to APAC’s rise. Analysts highlight that while North America remains the largest market, APAC is expected to be the global aviation growth leader over the next two decades.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

A significant challenge hindering growth in the Aircraft Engine MRO Market is the barriers to adopting new technologies and equipment. Integrating advanced systems such as 3D printing and automated diagnostics requires substantial capital investment and a highly skilled workforce, both of which are not always readily available—especially in developing regions. Additionally, LEAP engines and other next-generation models demand expensive materials and customized maintenance, complicating adoption. Military aviation also faces hurdles due to high obsolescence rates and the need for long-term infrastructure commitments. These barriers can delay modernization efforts and restrict the scalability of MRO operations, according to Technavio analysts.

Market research highlights a growing emphasis on digital integration and predictive strategies within engine MRO services. Operators are increasingly relying on predictive maintenance, engine diagnostics, and engine health tracking to prevent unscheduled downtimes. Tools like condition monitoring, engine monitoring, and engine testing are supported by innovative technologies such as digital twin modeling and engine analytics, which offer real-time performance insights. Engine leasing and engine spares availability are also emerging as key cost-optimization strategies for fleet operators. Advances in additive manufacturing and MRO software are reshaping traditional workflows, enabling more precise component repair, including engine disassembly, engine alignment, and blade balancing. These improvements support higher turnaround efficiency and reduced maintenance costs across global MRO networks.

In-depth research analysis reveals a rising focus on specialized services such as nacelle repair, corrosion protection, and engine coating, which are critical for extending engine longevity and ensuring environmental resistance. Moreover, heat exchanger maintenance, turbine cooling enhancements, and vibration analysis are being prioritized for performance stability and operational reliability. Regulatory compliance also plays a vital role, with engine certification processes becoming increasingly rigorous. Demand for engine refurbishment services is growing, particularly for aging aircraft fleets seeking cost-effective upgrades. As MRO providers expand their offerings, the integration of engine analytics and next-generation diagnostics is enabling deeper insights into engine behavior, fostering a more proactive and data-driven approach to aircraft engine maintenance worldwide.

To remain competitive, leading players in the Aircraft Engine MRO Market are adopting diverse strategies including strategic alliances, mergers and acquisitions, and facility expansion. Companies such as AAR Corp. provide services like scheduled maintenance, unscheduled repairs, boroscope inspections, and component overhauls, demonstrating comprehensive support across the maintenance cycle.

For example:

Airbus Helicopters and Lockheed Martin have established new MRO facilities in Singapore and Japan, respectively, to support growing demand in Asia.

The rise of digitization in maintenance processes is enabling MRO providers to reduce downtime and improve cost efficiency.

OEMs and service providers are forming joint ventures to address the labor shortage and technical complexity of modern aircraft engines.

Other notable companies active in the market include:

CFM International

Delta TechOps

General Electric Company

Pratt and Whitney

Rolls Royce Holdings Plc

Lufthansa Group

SIA Engineering Company

Singapore Technologies Engineering Ltd.

These players offer services ranging from engine diagnostics to full overhauls, and they often partner with airlines and military organizations to offer long-term maintenance contracts.

1. Executive Summary

2. Market Landscape

3. Market Sizing

4. Historic Market Size

5. Five Forces Analysis

6. Market Segmentation

6.1 Application

6.1.1 Commercial aviation

6.1.2 Military aviation

6.1.3 General aviation

6.2 Type

6.2.1 Turbofan and turbojet

6.2.2 Turboprop

6.3 Geography

6.3.1 North America

6.3.2 APAC

6.3.3 Europe

6.3.4 South America

6.3.5 Middle East And Africa

7. Customer Landscape

8. Geographic Landscape

9. Drivers, Challenges, and Trends

10. Company Landscape

11. Company Analysis

12. Appendix

Safe and Secure SSL Encrypted