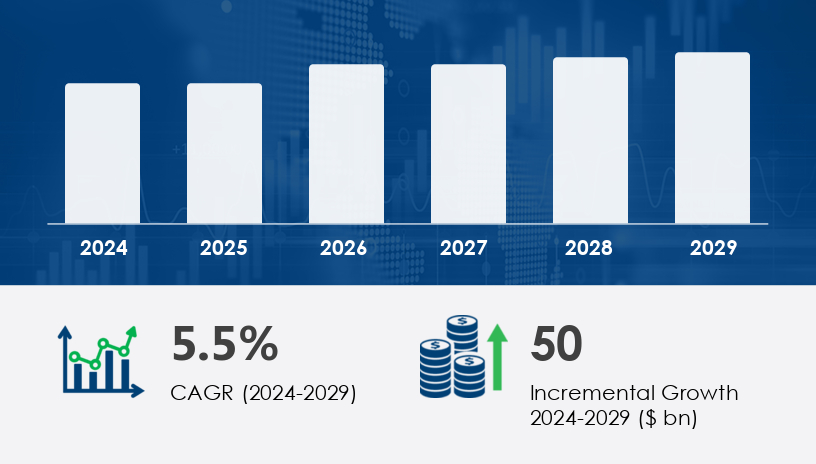

Agricultural Machinery Market Size 2025-2029

The agricultural machinery market is set to experience significant growth, projected to increase by USD 50 billion, with a CAGR of 5.5% from 2024 to 2029. This expansion is driven by government subsidies supporting the agricultural sector, a rise in the popularity of small tractors, and an increased demand for farm mechanization, especially in developing countries like India and China. The trend of offering agricultural tractors on a rental basis has also contributed to increased accessibility for farmers with limited budgets. Technological advancements, such as renewable energy-powered hybrid tractors and precision farming techniques, are further boosting market development.

For more details about the industry, get the PDF sample report for free

Agricultural Machinery Market Segmentation (2025-2029)

By Type

- Tractors

- Harvesting Machinery

- Haying Machinery

- Planting and Fertilizing Machinery

- Plowing and Cultivating Machinery

By Application

- Land Development and Seedbed Preparation

- Sowing and Planting

- Harvesting and Threshing

- Others

Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- North America

- South America

- Middle East and Africa

Market Dynamics

Drivers:

- Government Subsidies: Various government schemes, such as the Rashtriya Krishi Vikas Yojana (RKVY), the National Food Security Mission (NFSM), and NABARD loans, play a vital role in promoting farm mechanization by providing subsidies for purchasing agricultural machinery. For example, in 2023, the Indian government offered an 80% subsidy to farmers for maintaining stubble, aiding in the adoption of modern farming equipment.

Trends:

- Small Tractors' Popularity: Small tractors (less than 40 HP) are becoming increasingly popular, especially in developing countries. This trend is expected to boost the adoption of tractors in regions with small-scale farming operations.

- Hybrid and Electric Tractors: With rising concerns over sustainability, farmers are turning to energy-efficient solutions, including hybrid and electric tractors, to reduce their carbon footprints.

- Integration of Precision Farming: The integration of IoT, GPS, and AI-based machinery to monitor crop health, optimize resource usage, and reduce operational costs is gaining traction.

Get more details by ordering the complete report

Challenges:

- Agricultural Equipment Rental Models: The availability of tractors and machinery on a rental basis remains a challenge, especially in regions where farmers face financial constraints. While rental models help with accessibility, they may slow down the market's full potential in terms of adoption.

Key Market Players

- AGCO Corp.

- Agrale SA

- Bucher Industries AG

- CHANGFA GROUP

- Changzhou Dongfeng Agricultural Machinery Group Co. Ltd.

- CLAAS KGaA mBH

- CNH Industrial NV

- Daedong Corp.

- Deere and Co.

- Escorts Ltd.

- HORSCH Maschinen GmbH

- ISEKI and Co. Ltd.

- J C Bamford Excavators Ltd.

- Kubota Corp.

- Mahindra and Mahindra Ltd.

- SDF SpA

- Sonalika International Tractors Ltd.

- Tractors and Farm Equipment Ltd.

- Weichei Lovol Heavy Industry Co. Ltd.

- Yanmar Holdings Co. Ltd.

Future Market Insights

The agricultural machinery market is poised for substantial growth driven by government support, technological advancements, and increasing mechanization, particularly in developing countries. With sustainability becoming a priority and innovations in hybrid and electric tractors on the rise, the future of agricultural machinery will be marked by greater efficiency, cost-effectiveness, and eco-friendliness. As the demand for food grows globally, precision farming and robotics will play an increasingly vital role in optimizing farm operations, reducing environmental impact, and enhancing productivity.