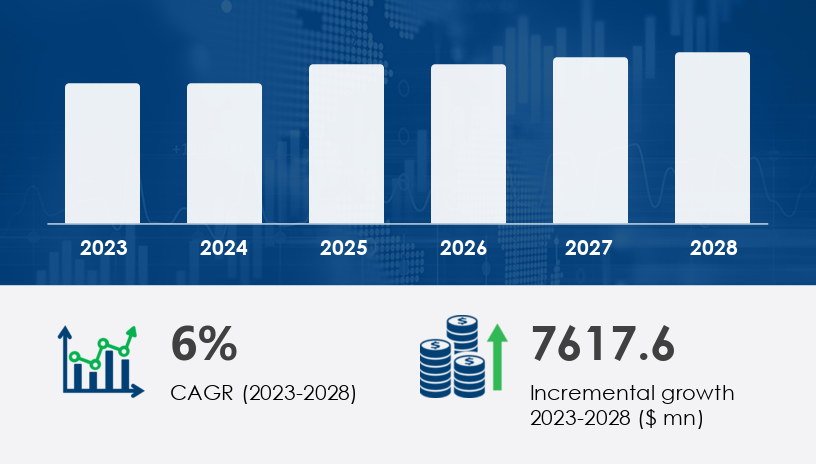

The adhesive films market is set for dynamic growth, projected to increase by USD 7.62 billion at a CAGR of 6% between 2023 and 2028. As demand surges across automotive, healthcare, and packaging sectors, this 2025 Outlook offers a comprehensive guide to the key segments shaping market expansion. In this article, we analyze the market’s segmental drivers, challenges, and future trajectories, providing actionable insights for industry stakeholders aiming to leverage growth opportunities in adhesive films.

For more details about the industry, get the PDF sample report for free

The adhesive films market is expanding steadily, driven by applications in tapes, labels, and graphics across diverse industries. Key raw materials like polymers and petroleum-based products significantly influence market dynamics, while technological innovations and evolving end-user demands fuel adoption.

| Segment | Key Highlights | Market Share (Estimate) |

|---|---|---|

| Application | Tapes, Labels, Graphics, Others | Tapes segment leads growth |

| End-User | Packaging, Aerospace, Electrical, Automotive | Packaging & Automotive dominant |

| Geography | APAC (China, Japan), North America (US), Europe | APAC drives 55% of global growth |

The tapes segment, valued at USD 9.26 billion in 2018, is experiencing significant growth due to rising demand in healthcare, automotive, and electronics. Medical-grade tapes like silicone and polyurethane are essential for surgical dressings, while automotive manufacturers use adhesive tapes to reduce vehicle weight by up to 30%, enhancing fuel efficiency.

However, stringent environmental regulations on volatile organic compounds (VOCs) pose a challenge, necessitating reformulations to meet compliance without compromising performance.

“The tapes segment is benefiting from innovations in polymer chemistry that improve durability and sustainability, key for automotive and medical applications.”

A leading automotive OEM in Japan implemented advanced adhesive tapes to replace mechanical fasteners in door panels, achieving a 15% weight reduction and improving assembly efficiency by 20%.

Adhesive tapes contribute to a 5-7% fuel efficiency gain through vehicle weight reduction.

APAC countries like China and India show rapid adoption, contributing significantly to global tapes demand.

See What’s Inside: Access a Free Sample of Our In-Depth Market Research Report

The automotive industry drives adhesive films market growth by using films for bonding composites, non-woven fabrics, and plastics. This adoption reduces vehicle weight and assembly complexity while enhancing component durability.

Challenges include raw material price volatility, particularly crude oil fluctuations affecting polymer costs, and compliance with increasing environmental regulations.

“Adhesive films are critical in advancing lightweight vehicle design, but manufacturers must navigate raw material supply chain risks carefully.”

An Indian automotive parts manufacturer partnered with a global adhesive films supplier to develop custom epoxy film adhesives, resulting in a 10% reduction in assembly time and improved component lifespan under extreme conditions.

Automotive applications account for a substantial portion of the adhesive films market expansion.

Nearly 30% vehicle weight reduction is achievable by replacing mechanical fasteners with adhesive films.

APAC dominates the adhesive films market, accounting for approximately 55% of global growth, driven by industrial expansion in China, Japan, India, and South Korea. Rising living standards, urbanization, and the growth of organized retail boost packaging and consumer goods demand.

Challenges include fluctuating raw material costs and stringent regional environmental regulations, requiring manufacturers to innovate continually.

“APAC’s adhesive films market growth is unparalleled, with sustainability initiatives and regulatory pressures shaping innovation and adoption.”

A South Korean packaging company adopted linerless adhesive films, cutting label waste by 40% and reducing costs while improving environmental compliance.

APAC is projected to contribute 55% of the global market growth by 2028.

Linerless adhesive labels reduce material waste by about 40%.

Expansion in emerging markets such as Southeast Asia and South America.

Increasing adoption of linerless tapes and labels to improve sustainability and reduce waste.

Growth in medical and healthcare adhesive films, driven by rising demand for medical tapes and dressings.

Innovation in solvent cast adhesives and epoxy films for aerospace and electronics sectors.

Volatility in crude oil prices impacting polymer-based raw material costs.

Stringent VOC regulations in North America and Europe restricting product formulations.

Intensifying competition from alternative bonding technologies.

Supply chain disruptions affecting capacity expansions and raw material availability.

The global adhesive films market is forecasted to grow at a steady CAGR of 6% through 2028, driven by expanding applications across automotive, packaging, and healthcare sectors. Market size is projected to increase by USD 7.62 billion, reflecting robust demand and technological advancements. As the industry evolves, are companies ready to pivot towards more sustainable and innovative adhesive film technologies to maintain competitive advantage?

Expert Prediction: “Sustainability and lightweighting will remain paramount. The next frontier lies in bio-based adhesives and eco-friendly polymers, pushing companies to pivot quickly.”

The Adhesive Films Market is witnessing robust growth driven by innovations in pressure sensitive and hot melt adhesive technologies, widely used across sectors such as flexible packaging, automotive adhesives, and electronic laminates. Key materials like acrylic adhesive, polyurethane films, and epoxy adhesive contribute significantly to bonding strength and shear resistance, essential for demanding applications in aerospace bonding and industrial bonding. The market favors self-adhesive and double-sided adhesive tapes that offer superior film lamination and surface adhesion. Advances in UV curable and silicone films enhance thermal stability and moisture barrier properties, making protective films and polymer films crucial in high-performance settings. Additionally, peel strength and film thickness optimization are vital parameters that manufacturers focus on to ensure effective substrate bonding and improved corrosion resistance.

Request Your Free Report Sample – Uncover Key Trends & Opportunities Today

Invest in R&D for low-VOC, eco-friendly adhesive formulations.

Focus on developing high-performance tapes for healthcare and automotive sectors.

Leverage long-tail keywords like "medical-grade silicone adhesive tapes" and "automotive lightweight adhesive films" for targeted marketing.

Strengthen supply chain resilience against raw material price fluctuations.

Collaborate with OEMs to develop custom adhesives addressing lightweighting and durability.

Emphasize "automotive epoxy film adhesives" and "composite bonding adhesive films" in content strategies.

Expand production capacity strategically in high-growth countries like China and India.

Promote sustainability through linerless label technology adoption.

Utilize SEO keywords such as "APAC adhesive films market growth" and "linerless adhesive label solutions."

In-depth analysis of the Adhesive Films Market highlights the rising demand for specialty adhesives such as conductive adhesives and insulation films, which play a pivotal role in electronics and high-temperature applications. The industry leverages adhesive coating techniques and die-cutting processes to produce low-tack and permanent bond films tailored for various uses. Features like optical clarity, anti-static, and anti-slip films enhance product versatility, especially in protective barrier films and vibration damping solutions. Removable adhesive variants provide flexibility in assembly and repair, while corrosion resistance and adhesion durability remain priorities for automotive and aerospace sectors. These innovations collectively drive the growth of adhesive layers designed for optimal performance in diverse environments, reinforcing the adhesive films market's strategic importance.

We found the adhesive films market poised for continued growth fueled by automotive, healthcare, and packaging applications, with APAC leading global expansion. Key drivers include technological innovation, sustainability trends, and increasing adoption of linerless adhesive films. Challenges around regulatory compliance and raw material costs remain significant but manageable with strategic planning.

For companies aiming to capitalize on this growth, understanding segment-specific dynamics and geographic trends is crucial.

Download our free Strategic Report for full 2025 insights and stay ahead in the adhesive films market.

Safe and Secure SSL Encrypted