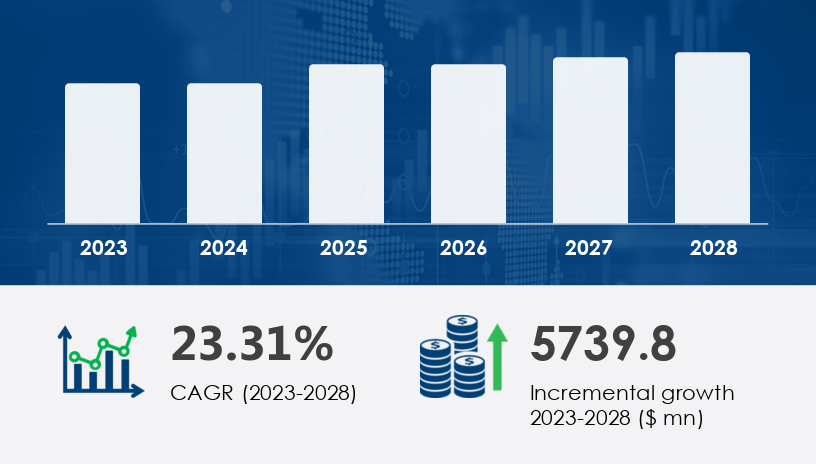

The 3D printing market in healthcare industry is undergoing transformative growth, fueled by increasing demand for personalized medical solutions and rapid advancements in printing technologies. In 2024, the market is positioned robustly and is forecast to expand by USD 5.74 billion by 2028, achieving a CAGR of 23.31% during the forecast period. This explosive growth signals a new era in the healthcare sector where precision, personalization, and production efficiency are paramount.For more details about the industry, get the PDF sample report for free

A major growth driver in the 3D printing market in the healthcare industry is the surging demand for customized medical devices, such as prosthetics, surgical instruments, and orthopedic implants. These devices are increasingly tailored to individual patients using anatomical data derived from medical imaging technologies like MRI and CT scans. Traditional manufacturing methods often fall short in offering such a high degree of personalization and geometric complexity. Analysts emphasize that this demand has spurred adoption across hospitals and surgical centers, particularly for fabricating complex lattice structures that enhance healing and bone integration. The use of biocompatible materials—including ceramics, plastics, elastomers, and even paper—is also helping manufacturers meet the rigorous safety and functionality standards of the biomedical sector.

Technological advancements in additive manufacturing are redefining the healthcare sector. Breakthroughs in bioprinting and stereolithography are enabling the creation of intricate, highly accurate structures. Multi-material printing techniques, such as droplet deposition, are now being used to replicate human tissue characteristics more closely. One notable trend is the growing integration of 3D printing into medical tourism, where personalized devices can be produced on-site, enhancing patient care and reducing treatment times. In addition to customization benefits, 3D printing significantly reduces material waste and lowers overall production time, making it a cost-effective alternative. These benefits are making advanced healthcare more accessible to remote and underserved populations.

Get more details by ordering the complete report

The 3D printing market in the healthcare industry is rapidly evolving, driven by innovations in 3D bioprinting, tissue engineering, and organ printing. These advancements are fueling applications in skin grafting, vascular grafts, and heart valve printing, revolutionizing how complex biological structures are recreated. Core materials such as biocompatible materials, PLA filament, and ABS filament are essential in fabricating bone scaffolds, cartilage repair solutions, and tissue scaffolds. Techniques like bioink printing, resin printing, FDM printing, and SLA printing enable the precise development of patient-specific models, anatomical models, and aids for surgical planning. This convergence of materials and methods supports a shift toward more customized, minimally invasive, and high-precision medical interventions.

The 3D printing market in healthcare is segmented as follows:

By Application: Orthopedic and Spinal, Dental, Hearing Aids, Others

By Technology: Stereolithography, Granular Materials Binding, Others

By Geography:

North America (U.S.)

Europe (Germany, France)

Asia (China, Japan)

Rest of World (ROW)

The Orthopedic and Spinal application segment stands out as the most dominant and rapidly growing area. Valued at USD 758.30 million in 2018, this segment continues to grow due to rising demand for patient-specific implants tailored to individual skeletal anatomies. Hospitals increasingly use 3D printing for implants and prosthetics designed with lattice geometries that promote bone ingrowth and accelerate post-surgical recovery. Experts suggest that these advancements are revolutionizing orthopedic care, providing superior solutions for conditions like osteoporosis, osteoarthritis, and osteopenia through enhanced anatomical precision and customization.

For more details about the industry, get the PDF sample report for free

North America remains a key market, driven by robust investments in healthcare innovation and strong R&D support. U.S.-based healthcare facilities are early adopters of advanced 3D printing systems, especially in areas such as dental prosthetics, hearing aids, and organ scaffolds.

Europe is projected to contribute 35% of global market growth during the forecast period, making it the top-performing region. Germany and France are leading the charge in integrating 3D printing into surgical workflows and biomedical research. The region benefits from a highly developed healthcare infrastructure and proactive government policies supporting innovation in minimally invasive surgical techniques. European surgical centers are pioneers in using CAD and 3D printing for procedures like dental reconstructions and organ transplants, setting a global benchmark.

Countries like China and Japan are ramping up investments in healthcare 3D printing, driven by growing demand for affordable and high-quality medical care. Expanding hospital infrastructure and rising geriatric populations are further fueling adoption.

Despite promising growth, a key obstacle is the high initial cost of 3D printing technology. Professional-grade systems can cost between USD 200,000 and USD 850,000, while even desktop units range from USD 3,000 to USD 15,000. Beyond hardware, healthcare providers must invest in specialized software, proprietary materials, and skilled technical staff. This cost-intensive setup poses a barrier, particularly for small clinics and emerging markets. Furthermore, justifying the ROI becomes challenging for providers handling low-volume, high-complexity cases in underserved areas.

Rapid advancements in additive manufacturing methods, including SLS printing, DMLS printing, and metal 3D printing, have broadened the scope of healthcare applications. These techniques are widely employed to manufacture robust, high-precision components such as titanium implants, PEEK implants, and ceramic printing parts, vital for spinal implants, cranial implants, and orthopedic implants. Simultaneously, demand is growing for personalized external devices like 3D printed braces, orthotic devices, and hearing aids, which enhance patient mobility and comfort. The dental segment is also experiencing transformation through the production of dental crowns, dental aligners, and surgical guides. These applications are redefining patient care by minimizing lead times and improving fit and functionality across various demographics.

For more details about the industry, get the PDF sample report for free

The integration of 3D printing into clinical workflows is also driving demand for advanced medical implants and prosthetic limbs, offering custom-fit, lightweight, and patient-specific solutions. Innovations in custom prosthetics, 3D printed casts, and bone substitutes continue to gain momentum, supported by extensive medical prototyping and 3D printed splints for rehabilitation. In drug delivery, the rise of 3D printed pills, drug delivery devices, and bioresorbable implants demonstrates the potential of additive manufacturing in pharmaceutical customization. Supporting structures like polymer scaffolds ensure optimal therapeutic outcomes. The evolution of medical prototyping has further facilitated the design and validation of next-gen surgical guides, enabling faster iteration and safer surgeries. As healthcare continues to embrace personalization and precision, the market is poised for accelerated growth driven by these transformative technologies.

Leading companies in the market are adopting a combination of strategic alliances, product innovation, and regional expansion to stay ahead. Key players include:

3D Systems Corp.

Formlabs Inc.

Stratasys Ltd.

Materialise NV

GE Co.

These companies are investing in the development of advanced bioprinting and stereolithography systems tailored specifically for medical use. Innovations such as multi-material printing capabilities and cloud-integrated design platforms are helping to streamline clinical workflows and reduce the learning curve for healthcare professionals. Portable 3D printing units are another emerging innovation, particularly effective in remote or underserved regions, contributing to the broader goal of healthcare democratization.According to analysts, dominant players are prioritizing customizable platforms that use biocompatible materials to treat a wider range of medical conditions. Use cases now include external wearable devices, anesthesia equipment, and even implants customized for organ transplant procedures. WHO-affiliated analysts highlight that these advances are particularly promising for developing countries with limited surgical infrastructure and resources.

Safe and Secure SSL Encrypted