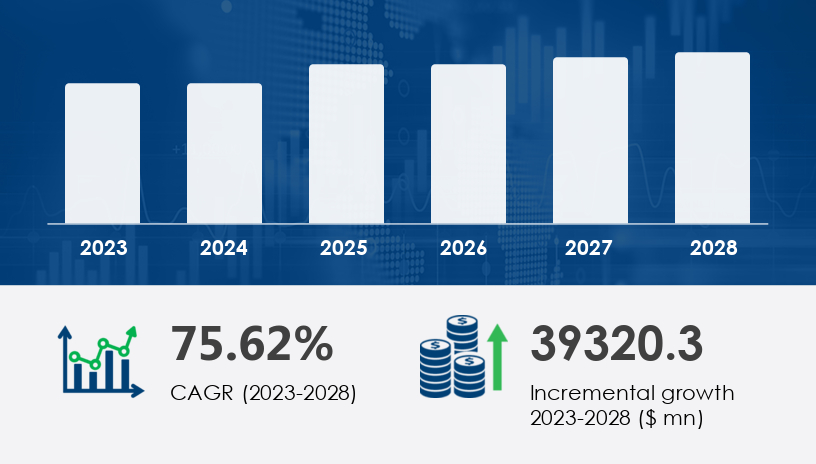

The 3D printing in low-cost satellite market is set for explosive growth, with forecasts projecting a USD 39.32 billion increase at a staggering CAGR of 75.62% between 2023 and 2028. As space-based services become increasingly integral across industries, the adoption of additive manufacturing (AM) techniques is revolutionizing the way satellites are built—reshaping not only costs and timelines but also the core of space innovation.For more details about the industry, get the PDF sample report for free

Key Driver: Proliferation of Low-Cost Satellite Missions

The primary force fueling this market is the rapid deployment of low-cost satellites, with 3D printing technology enabling the production of lightweight, durable components at lower costs. From antennas and brackets to shields and propulsion systems, additive manufacturing is significantly reducing turnaround times and materials waste. Organizations like NASA and commercial satellite providers are increasingly leveraging these capabilities to meet budget constraints and speed up satellite deployment cycles.

Emerging Trend: Space Exploration Initiatives Using 3D-Printed Components

An uptick in space exploration missions using 3D-printed parts—such as solar panels, structural frameworks, and propulsion units—has marked a paradigm shift in manufacturing. By 2023, several launches had already integrated these components, underlining a clear trend: advanced 3D printing is becoming a backbone of scalable, sustainable space systems, particularly in small satellite constellations involving Nano and Microsatellites.

Critical Challenge: Scalability and Material Compatibility

Despite these advancements, scalability remains a significant hurdle. While 3D printing excels at creating intricate parts in small volumes, scaling production for large constellations is still technically and economically challenging. Additionally, material compatibility—specifically, finding lightweight yet high-performance materials suitable for extreme space conditions—poses ongoing constraints that must be addressed through continued R&D collaboration among manufacturers, material suppliers, and technology providers.

Among the market's core application areas, Aerospace and Defense is expected to witness the highest growth through 2028. The segment was already valued at USD 389.10 million in 2018 and has since gained momentum due to the increasing demand for affordable, efficient satellite technology tailored for strategic operations, reconnaissance, and real-time data gathering.

3D printing is playing a pivotal role by enabling the development of components that are not only cost-effective but also highly customizable. This agility is crucial in military applications where mission-specific designs are essential. Additionally, defense-related low-cost satellite programs benefit from the lightweight nature of printed parts, contributing to faster and more affordable launches.

The market is segmented into the following key product categories:

Power System

Framework

Antenna

Each product segment benefits from additive manufacturing's ability to reduce complexity and consolidate multiple functions into single, monolithic components. This not only enhances structural integrity but also reduces the weight and volume of satellites—essential for fitting into tighter launch configurations and lowering orbital deployment costs.

Beyond aerospace and defense, 3D-printed satellite components are being integrated into services spanning:

Communication

Earth Observation

Navigation

Internet Access

Telecommunications

Broadcasting Services

Military Operations

As private companies and space agencies scale up deployment of small satellites, the flexibility of 3D printing supports rapid prototyping and iteration, enabling fast adaptation to emerging service needs and mission requirements.

North America is projected to contribute 47% of the global market growth through 2028. The region's leadership is anchored by robust activity in the United States and Canada, driven by investments from both government and private sectors.

In the U.S., NASA and a host of commercial satellite ventures are pioneering the use of 3D printing for mission-critical components. From navigation to military intelligence, satellite systems manufactured using additive techniques are enhancing operational capabilities while trimming down production costs and development times.

Key Country-Specific Trends:

United States: Rapid growth in the civilian space sector, rising commercial demand for low-cost satellites.

Canada: Expanding focus on space communications and Earth observation programs.

Elsewhere, regional demand is expanding across:

Europe (Germany, UK)

Asia-Pacific (China, Japan)

South America

Middle East and Africa

These regions are gradually increasing their stakes in small satellite constellations, leveraging 3D printing to reduce dependency on traditional manufacturing chains and make satellite services more accessible.

The 3D Printing in Low-Cost Satellite Market is rapidly gaining momentum due to the increasing adoption of 3D-printed satellites and low-cost satellites for various space missions. The use of additive manufacturing has revolutionized satellite components production, especially in the realm of small satellites and CubeSat production, driving down costs and lead times. With advanced 3D printing technology, the industry is witnessing a surge in aerospace innovation, especially in critical parts like satellite antennas, lightweight components, and systems for space exploration. Innovations extend to satellite propulsion, which is now being enhanced for Earth observation and internet satellites applications. One key advantage of 3D printing is rapid prototyping, enabling quick iteration of custom satellite parts, including satellite brackets and 3D-printed housings. The rising use of aerospace 3D printing has also brought advancements in protective structures such as satellite shields and low-cost CubeSats, improving space mission efficiency and reliability.

Get more details by ordering the complete report

A core group of industry leaders is shaping the strategic direction of this market:

Airbus SE

EOS GmbH

L3Harris Technologies Inc.

Lockheed Martin Corp.

Stratasys Ltd.

The Boeing Co.

These companies are employing strategies including geographic expansion, mergers and acquisitions, and product launches to enhance their presence and solidify their roles in the evolving low-cost satellite ecosystem. Through focused R&D, strategic alliances, and advanced material development, these players are driving competitive differentiation in a fast-scaling market.

The adoption lifecycle in the 3D printing for low-cost satellites market spans from early-stage innovators to laggards, with high adoption rates observed in regions with robust space infrastructure and commercial space investment. Companies are increasingly evaluating price sensitivity, customization needs, and turnaround speed as key criteria for adopting additive manufacturing solutions.

The integration of 3D printing into satellite production workflows offers not just cost benefits, but also greater design flexibility, enabling rapid development and iteration cycles. This is particularly valuable in time-sensitive applications such as military reconnaissance and commercial satellite constellation.

For more details about the industry, get the PDF sample report for free

Analytical insights into the market show significant growth in satellite design refinement using advanced 3D printing materials tailored for robust satellite payloads. This innovation also addresses challenges such as orbital debris by enabling compact and disposable structures, as seen in minisatellite production and nanosatellite components. Additionally, microsatellite manufacturing benefits from the use of precise satellite frames and 3D-printed structures that include functional satellite panels and thermal protection systems. Sensors, optics, and communication are now integrated with satellite sensors, 3D-printed waveguides, and miniaturized satellite thrusters. The integration of spacecraft components is optimized with strong 3D printing alloys that contribute to resilient satellite chassis and high-accuracy precision manufacturing. Technological progress also enables the development of advanced satellite optics and embedded 3D-printed circuits, underscoring the transformative impact of 3D printing across the entire satellite manufacturing lifecycle.

Safe and Secure SSL Encrypted